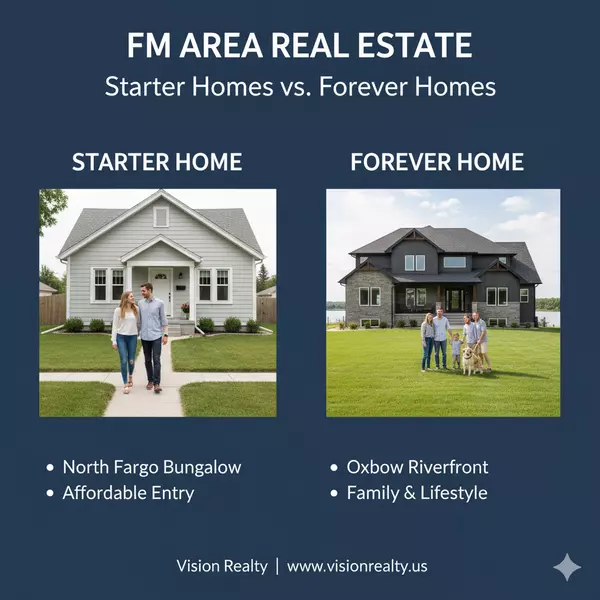

Starter Homes vs. Forever Homes: Tailored Strategies for Fargo-Moorhead Buyers

Starter Homes vs. Forever Homes: Tailored Strategies for Fargo-Moorhead Buyers

By Christopher Leigh | September 24, 2025, 03:00 PM CDT

Category: Home Buying Tips

In Fargo-Moorhead’s dynamic housing market—where median home prices stand at $384,100 and a balanced 2.8-month inventory offers choice—buying a home requires a tailored approach depending on whether it’s your first step or your final destination. Starter homes build wealth for future upgrades, while forever homes anchor decades of life in communities like Sabin’s serene retreats or Moorhead’s family-friendly enclaves. As a licensed real estate broker with Vision Realty, I’ve guided clients through both journeys, leveraging our market’s 8% annual appreciation to maximize outcomes. Drawing from national insights and local trends, let’s explore how to approach starter and forever homes in Fargo-Moorhead with distinct strategies for success.

Starter Homes in FM: Building Wealth and Flexibility

A starter home is your entry into homeownership, prioritizing affordability and equity-building over long-term perfection. “It’s about getting into the market and learning your priorities,” says Amanda Elhassan of Keller Williams Realty of Livermore, CA. In FM, where 30% of buyers are first-timers (NAR 2025), a $300,000 two-bedroom in North Fargo’s walkable core can appreciate $24,000 in a year at 8%—equity for future moves.

Focus on:

-

Affordability: FHA loans (3.5% down) suit FM’s $1,200 median rents, saving versus rent hikes (5% YoY).

-

Resale Potential: Choose neutral, updated homes in high-demand ZIPs like 58102 (15% inventory rise).

-

Flexibility: Prioritize layouts you can outgrow in 5-7 years, like condos in Dilworth.

Elhassan sold her starter for a $165,000 profit, funding her next home—FM’s market supports similar gains with smart buys.

Forever Homes in FM: Crafting a Lifelong Haven

A forever home is about lifestyle longevity—think schools, community, and adaptability for aging or family growth. In FM, where 65% of families own homes (Census 2024), forever homes in Prairie Rose or Oxbow’s riverfront offer space for nurseries or home offices.

Key considerations:

-

Long-Term Fit: Opt for single-level ranches in Glyndon for aging-in-place or multi-use rooms for kids.

-

Community: Research school funding (FM’s districts rank top 10% nationally) and amenities like Red River trails.

-

Durability: Prioritize flow, storage, and climate-resilient builds for ND winters.

Tami Pardee of Pardee Properties advises: “Marry the life you want; date the math.” Stretch budgets for forever homes—FM’s $3,000 property taxes justify measured splurges.

Key Differences in FM Search Strategies

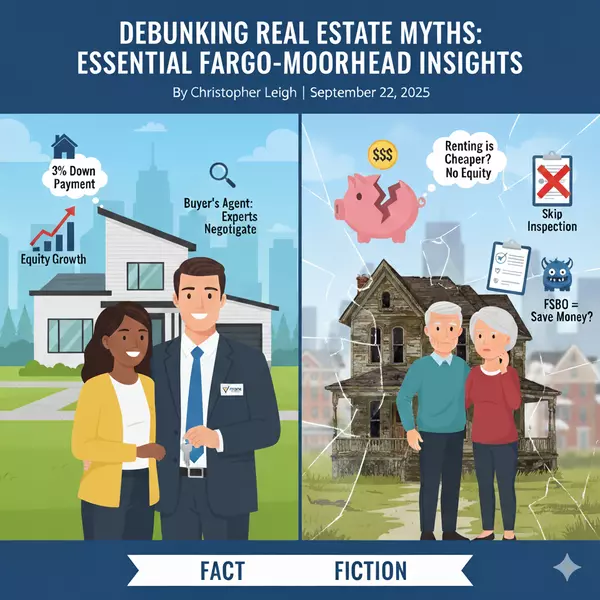

Starter Homes: Speed matters—FM’s 45-day sales pace demands quick offers. Focus on low-down loans (NDHFA’s FirstHome, 3%) and high-ROI fixes (paint, 100% recoup). Avoid overbuying to preserve cash flow.

Forever Homes: Patience is key—spend weekends in Horace to gauge neighborhood vibe. Dig into city plans (Fargo’s 2045 Vision avoids future disruptions). Prioritize adaptability (e.g., convertible basements) over trendy features like reading nooks.

Alan Taylor, a seasoned agent, warns: “Don’t buy for today only—envision 10 years ahead.” In FM, a starter’s cramped kitchen is fine for now; a forever home’s needs enduring functionality.

Avoiding Common Mistakes in FM Homebuying

The biggest pitfall? Ignoring future needs. Starter buyers in Cass County might skip inspections to compete, risking $10K repairs in older homes (median build 1985). Forever buyers might chase dream features without considering aging (e.g., multi-story homes in West Fargo). Balance today’s budget with tomorrow’s lifestyle—FM’s 15% inventory rise in 2025 offers choice, but foresight wins.

How to Approach Your FM Home Search

Tailor your strategy to your goal:

-

Define Your Home Type: Starter (quick equity) or forever (lifestyle fit)? Clarify upfront.

-

Get Pre-Approved: Use FM lenders like Gate City Bank for 3-3.5% down loans.

-

Research Neighborhoods: North Fargo for starters; Moorhead for forever homes’ schools.

-

Inspect Wisely: Never skip—15% of FM listings have issues (FM Realtors).

-

Plan Ahead: Starters, aim for 5-7 years; forever, envision 20+ years.

Frequently Asked Questions

Q: How much can I save with a starter home in FM?

A: $24K/year equity at 8% appreciation on $300K; beats $1,200 rents (up 5% YoY).

Q: Are forever homes pricier in FM?

A: Yes—$450K for family-sized vs. $300K starters, but long-term savings skip moving costs.

Q: Should I stretch my budget for a forever home?

A: Moderately—$3K taxes and 6.3% rates justify it if schools/amenities align.

Q: Can I skip inspections for FM starters?

A: Avoid—older homes hide issues; inspections save $5K-$10K in repairs.

Conclusion

Fargo-Moorhead’s market rewards tailored homebuying—starter homes build wealth in vibrant North Fargo, while forever homes anchor lifelong dreams in family-centric Moorhead. By aligning strategies with your stage—equity for starters, lifestyle for forever—you’ll maximize value and satisfaction. At Vision Realty, my broker expertise guides you to the perfect FM fit—contact us to start your journey today.

Contact Vision Realty

Phone: (701) 715-4747

Email: chris@visionrealty.us

Website: www.visionrealty.us

Serving Fargo, Moorhead, West Fargo, and beyond.

References

-

National Association of Realtors. (2025). Profile of Home Buyers and Sellers.

-

Fargo-Moorhead Association of Realtors. (2025). Market Trends: Q3 2025.

-

U.S. Census Bureau. (2024). Fargo-Moorhead Housing Data.

-

North Dakota Housing Finance Agency. (2025). FirstHome Program Details.

-

Remodeling Magazine. (2025). Cost vs. Value Report.

Disclaimer

This article provides general real estate insights and is not intended as legal or financial advice. All data is based on publicly available sources as of September 2025 and subject to change. Vision Realty complies with all Fair Housing laws, promoting equal opportunity without regard to race, color, religion, sex, disability, familial status, or national origin. Consult licensed professionals for transaction-specific guidance.

Categories

Recent Posts

GET MORE INFORMATION