IRS Tax Bracket Adjustments for 2026: A Boost for Fargo-Moorhead First-Time Homebuyers

IRS Tax Bracket Adjustments for 2026: A Boost for Fargo-Moorhead First-Time Homebuyers

By Christopher Leigh | September 23, 2025, 09:00 AM CDT

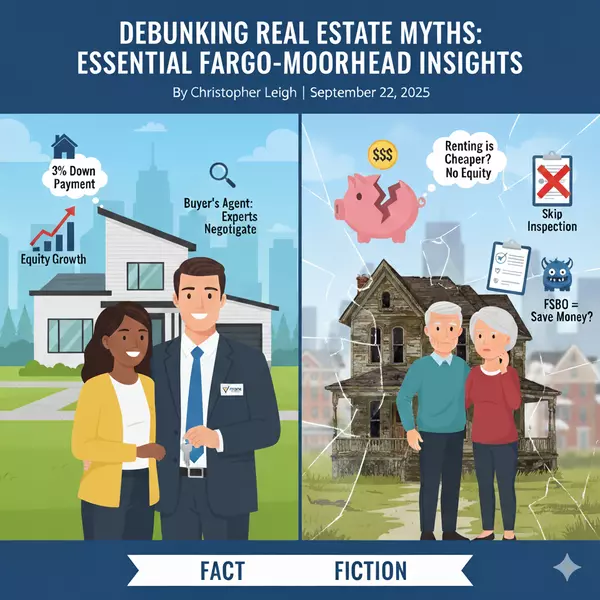

As Fargo-Moorhead's housing market evolves, with median prices at $384,100 and a balanced 2.8-month inventory supply, first-time buyers are gaining ground. The National Association of Realtors notes that 30% of FM buyers are first-timers, drawn to our affordability edge—15% below national medians. Now, expected 2026 IRS tax bracket adjustments, projected by Bloomberg Tax to rise 2.7% (with 4% bumps for lower brackets), add momentum. These changes, set for release in late 2025, increase take-home pay, easing down payment savings or debt-to-income ratios for young professionals near Sanford Medical or families eyeing Glyndon's quiet streets. As a realtor with Vision Realty, I've seen small financial shifts make big homeownership dreams possible—let's explore how these tax tweaks can help you break into the FM market.

Understanding Tax Brackets: Why They Matter for FM Homebuyers

Income taxes operate on a tiered system, not a flat rate. Your earnings split into brackets, each taxed progressively—10% for the first portion, 12% for the next, and so on. Your marginal tax rate is the highest bracket your income hits, while your effective tax rate (total tax divided by income) is often lower. For a single FM filer earning $60,000 in 2025, the first $11,925 is taxed at 10%, $11,926-$48,475 at 12%, and the rest at 22%, yielding an effective rate near 11.5%.

Inflation adjustments prevent "bracket creep," where raises push you into higher taxes without real income gains. For 2026, the IRS is expected to lift brackets by 2.7%, with low earners seeing up to 4% per the One Big Beautiful Bill Act (OBBBA). In FM, where median household income is $78,500, this could mean $500-$1,000 more annually for a $50,000 earner—crucial for saving toward a $12,000 down payment on a $300,000 starter in Sabin.

How 2026 Adjustments Benefit Fargo-Moorhead First-Timers

The projected 2.7-4% bracket hikes translate to modest but meaningful boosts. For a couple earning $80,000 combined (common for FM's tech workers), a 3% adjustment could lower their effective tax rate from 12.5% to 12%, freeing $600-$800 yearly. "Every penny counts in today's affordability crunch," says Aaron Razon of Couponsnake. In FM, this cushions 6.3% mortgage rates or $3,000 closing costs.

Additionally, OBBBA's tax breaks on overtime and tips—key for service workers near downtown Fargo's eateries—enhance disposable income. A server earning $40,000 with $10,000 in tips might save $400 annually, bolstering pre-approval odds with lenders like Gate City Bank.

The Changing Landscape of Homeownership Tax Perks in FM

Historically, homeownership's tax allure was mortgage interest and property tax deductions. Post-OBBBA, the permanent higher standard deduction ($15,750 for singles, 2025) often outpaces itemizing for FM buyers, where property taxes average $3,000 and interest on a $300,000 loan is $18,000 initially. Most opt for the standard deduction, simplifying filings but muting immediate tax breaks.

This isn't a loss—FM's real payoff is long-term: 8% yearly appreciation builds equity ($24,000 on a $300,000 home in one year), and fixed mortgages stabilize costs versus rising $1,200 rents. For high-tax states, new $40,000 SALT caps aid itemizing, but FM's lower taxes (2.5% effective rate) favor simplicity.

Navigating FM's Market with Tax Savings

Our balanced market—23% of U.S. metros neutral per Realtor.com—gives FM buyers leverage. Use tax savings strategically:

- Calculate New Income: Estimate 2026 take-home pay with IRS projections; online tools like SmartAsset adjust for FM taxes.

- Boost Savings: Funnel $50-$100 monthly from tax relief to down payments—$600/year covers 5% on a $12,000 condo deposit.

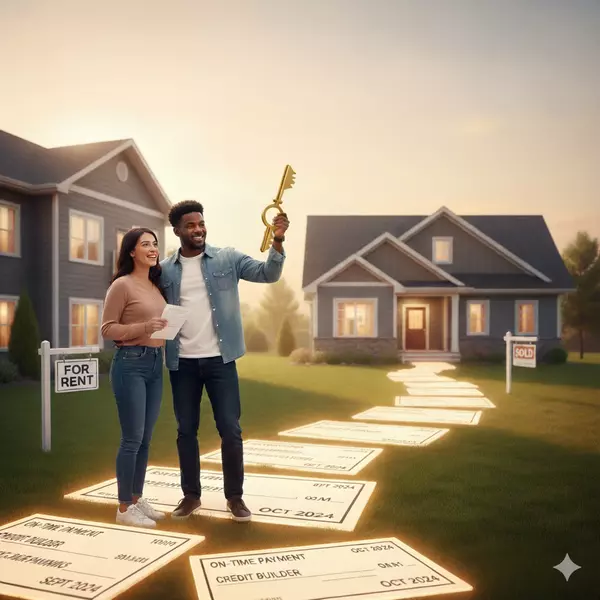

- Explore Low-Down Loans: NDHFA's FirstHome needs 3%; pair with tax savings for $9,000 on a $300K home.

- Target Softening ZIPs: North Fargo (58102) sees 15% inventory rises—perfect for first-timers.

- Get Pre-Approved: Work with FM lenders like Alerus to lock rates, using extra cash to lower DTI ratios.

Frequently Asked Questions

Q: How much extra income might I see in FM from 2026 tax adjustments? A: $500-$1,000/year for $50K-$80K earners, per Bloomberg Tax—enough for 5-10% of a starter down payment.

Q: Do tax breaks make homeownership cheaper than renting in FM? A: Indirectly—savings aid down payments; ownership's 8% appreciation outpaces $1,200 rent hikes (5% YoY).

Q: Is itemizing still worth it for FM buyers? A: Rarely—$3K taxes + $18K interest often fall below $15,750 standard deduction; confirm with a tax pro.

Q: Can tip income tax breaks help service workers buy in FM? A: Yes—$400-$600/year extra for $10K tip earners boosts mortgage qualification at local banks.

Q: When should I start planning for 2026 FM purchases? A: Now—use fall 2025 to save tax windfalls; spring 2026's inventory bump favors first-timers.

Conclusion

Fargo-Moorhead's balanced market, paired with 2026 IRS tax bracket boosts, hands first-time buyers a rare edge. From extra take-home pay for down payments to stable costs over rising rents, these shifts empower young families in Dilworth or professionals near Moorhead's campus to plant roots. At Vision Realty, we turn tax savings into keys—connect today to map your homeownership path.

Contact Vision Realty Phone: (701) 715-4747 Email: chris@visionrealty.us Website: www.visionrealty.us Serving Fargo, Moorhead, West Fargo, and beyond.

References

- Realtor.com. (2025). Monthly Housing Market Trends Report: August 2025.

- Bloomberg Tax. (2025). Projected 2026 IRS Tax Bracket Adjustments.

- National Association of Realtors. (2025). FM Buyer Demographics Report.

- Fargo-Moorhead Association of Realtors. (2025). Market Trends: Q3 2025.

- Bureau of Labor Statistics. (2025). FM Income Data: 2024.

- North Dakota Housing Finance Agency. (2025). FirstHome Program Overview.

Disclaimer

This article provides general real estate and tax insights and is not intended as legal or financial advice. All data is based on publicly available sources as of September 2025 and subject to change. Vision Realty complies with all Fair Housing laws, promoting equal opportunity without regard to race, color, religion, sex, disability, familial status, or national origin. Consult licensed professionals for transaction-specific guidance.

Categories

Recent Posts

GET MORE INFORMATION