Debunking Common Real Estate Myths: Essential Insights for Fargo-Moorhead Buyers and Sellers

Debunking Common Real Estate Myths: Essential Insights for Fargo-Moorhead Buyers and Sellers

By Christopher Leigh | September 22, 2025, 09:00 AM CDT

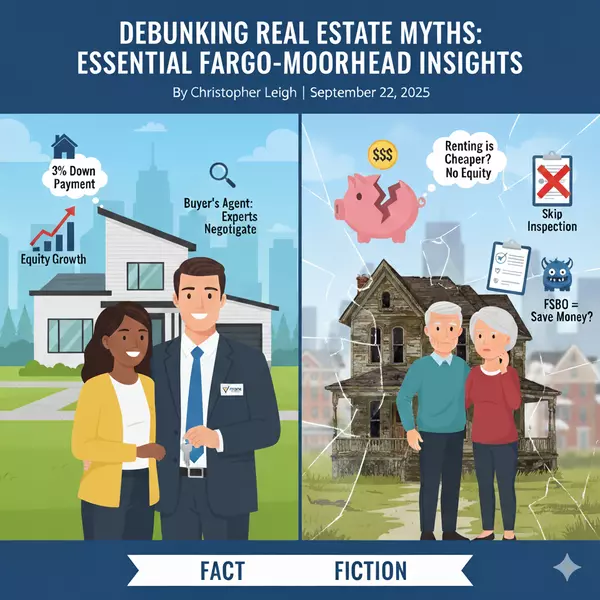

In the dynamic Fargo-Moorhead real estate scene—where steady population growth from sectors like healthcare and tech keeps demand robust—misconceptions can derail even the most prepared buyers and sellers. With our area's unique blend of affordable Midwest pricing and seasonal market shifts, separating fact from fiction is key to confident decisions. According to the National Association of Realtors (NAR), 75% of first-time buyers fall prey to common myths, often leading to missed opportunities or costly errors. As a realtor with Vision Realty, I've helped clients in neighborhoods from downtown Fargo's urban vibe to Moorhead's suburban serenity navigate these pitfalls. Drawing from widespread U.S. trends that resonate locally in North Dakota and Minnesota—especially post-NAR settlement changes—let's bust the top myths for buyers and sellers to empower your next move.

Top Myths for Buyers: What FM Home Shoppers Need to Know

Buyers in Fargo-Moorhead often enter the market with outdated assumptions, especially amid our 6.3% mortgage rates and 2.8 months' inventory supply. Here's the reality behind some of the most persistent ones.

One major myth is that you need a 20% down payment to buy. While it avoids private mortgage insurance (PMI) and secures better rates, it's far from mandatory. FHA loans allow 3.5% down, and conventional options start at 3%—ideal for young professionals near NDSU saving amid rising rents (up 5% YoY to $1,200 for two-beds). Delaying for 20% could cost more if prices climb 7% annually, as seen locally.

Another: Renting is always cheaper than buying. Rent builds no equity, and FM landlords can hike rates yearly, while fixed mortgages stabilize costs. Homeowners here gain from 8% average appreciation, turning a $300,000 Horace starter into $324,000 in a year—wealth-building absent in rentals.

Many think they don't need an agent, but in competitive spots like West Fargo, a buyer's agent provides crucial expertise in navigating negotiations, paperwork, and inspections—often securing better terms like credits or repairs. Following the 2024 NAR settlement, buyers must sign written agreements upfront clarifying compensation, which remains fully negotiable; sellers may still offer to cover it, but buyers should budget accordingly and discuss fees openly with their agent to avoid surprises. This transparency protects you without the misconception of it being entirely "free."

Skipping inspections in hot markets? Risky—FM's older homes (median build 1985) hide issues like foundations or roofs; inspections uncover them for negotiations, preventing post-close regrets.

Finally, assuming asking prices are fixed ignores negotiation room. In balanced FM, offers can include closing cost concessions, especially in winter when serious buyers dominate.

Key Myths for Sellers: Avoiding Costly Missteps in the FM Market

Sellers face their own folklore, often leading to prolonged listings in our region's seasonal slowdowns.

Overpricing for "negotiation room" backfires: Buyers compare via MLS, and stagnant homes signal problems, forcing drops below fair value. In Cass County, overpriced listings sit 60+ days versus 45 for comp-aligned ones.

Major pre-sale renovations? Not always wise—FM buyers prefer personalization; focus on high-ROI fixes like paint (recouping 100% per Cost vs. Value Report) over full kitchens (60-70% return).

FSBO to save commissions? NAR stats show FSBOs sell 10-15% less; agents market broadly, handle ND/MN disclosures, and net higher prices—post-settlement, clear fee agreements enhance this value.

Inspections aren't "pass/fail"—they inform negotiations; disclosing issues upfront complies with local laws and builds trust.

Selling only in spring/summer? Winter works in FM—fewer competitors, motivated buyers, and holiday coziness shine in showings.

Additional Myths: Credit, Financing, and Market Timing in Fargo-Moorhead

Deeper misconceptions affect both sides, especially in our credit-conscious market.

Buyers: Perfect credit isn't required—FHA accommodates 580+ scores; lenders review full profiles, enabling approvals for debt-laden grads.

Don't max your pre-approval—stay under to avoid being "house poor" amid FM's $3,000 average property taxes.

Prequal vs. pre-approval? The latter's verification strengthens offers in bidding scenarios.

No home checks every wishlist—prioritize needs (beds/schools) over wants (granite counters).

Cheapest house in the best hood? Beware renovation traps in older FM areas.

Sellers: Dismiss first offers? Often the strongest in our market.

Unrepresented buyers save money? They complicate deals; pros smooth closings.

Zestimates set value? No—CMAs from agents account for FM nuances.

Major renos recoup fully? Rarely; stick to curb appeal.

Hide problems? Illegal in ND/MN—disclose for ethical sales.

New builds skip agents? Builder reps favor builders; buyer agents negotiate extras.

Time the market? Buy/sell when ready—FM's steady growth rewards action.

How to Debunk Myths and Navigate the FM Real Estate Market

Arm yourself with facts—here's a step-by-step for buyers and sellers:

- Educate Yourself: Review NAR resources or local FM Realtors reports; attend seminars on ND/MN laws.

- Consult Pros: Engage agents/lenders early for CMAs or pre-approvals tailored to FM.

- Verify Finances: Pull free credit reports (AnnualCreditReport.com); explore low-down options like NDHFA's FirstHome.

- Inspect Thoroughly: Always include contingencies; use FM pros for winter-ready checks.

- Negotiate Smart: Price to comps; seek concessions like repairs in balanced seasons.

Frequently Asked Questions

Q: Do I really need 20% down in Fargo-Moorhead? A: No—3-3.5% suffices for many loans; local programs like MN Housing's Start Up help first-timers.

Q: Is renting cheaper long-term in FM? A: Often not—ownership builds equity with 7% appreciation; rents rose 5% YoY to $1,200 medians.

Q: Can I sell FSBO to save in ND/MN? A: Rarely—agents net 10-15% more per NAR; FSBOs risk disclosure violations.

Q: Should I waive inspections in competitive FM bids? A: Avoid—older stock hides issues; use reports to negotiate $5K+ credits.

Q: Is perfect credit mandatory for FM mortgages? A: No—580+ works for FHA; lenders factor income/debt holistically.

Conclusion

Fargo-Moorhead's market thrives when myths give way to informed strategies—whether busting down payment barriers for buyers or pricing pitfalls for sellers. In our resilient economy, truth empowers: Agents guide, inspections protect, and flexibility wins. Don't let folklore hold you back; embrace facts for seamless transitions. At Vision Realty, we demystify the process, tailoring advice to your FM journey—reach out to turn myths into milestones.

Contact Vision Realty Phone: (701) 715-4747 Email: chris@visionrealty.us Website: www.visionrealty.us Serving Fargo, Moorhead, West Fargo, and beyond.

References

- National Association of Realtors. (2024). Profile of Home Buyers and Sellers. Retrieved from https://www.nar.realtor/research-and-statistics/research-reports/profile-of-home-buyers-and-sellers

- Fargo-Moorhead Association of Realtors. (2025). Market Trends Report: Q3 2025.

- Remodeling Magazine. (2025). Cost vs. Value Report.

- Consumer Financial Protection Bureau. (2024). Mortgage Myths Guide.

- North Dakota Housing Finance Agency. (2025). FirstHome Program Details.

- National Association of Realtors. (2024). NAR Settlement FAQs. Retrieved from https://www.nar.realtor/the-facts/nar-settlement-faqs

Disclaimer

This article provides general real estate market insights and is not intended as legal or financial advice. All data is based on publicly available sources as of September 2025 and subject to change. Vision Realty complies with all Fair Housing laws, promoting equal opportunity without regard to race, color, religion, sex, disability, familial status, or national origin. Consult licensed professionals for transaction-specific guidance.

Categories

Recent Posts

GET MORE INFORMATION