I Heard The Housing Market Is About To Collapse?

“I Heard The Housing Market Is About To Collapse?”

Question: I keep seeing comparisons between the housing market right now and the housing market in the U.S. right before the “bubble burst” in 2007/2008. Should I wait to buy a home?

Answer: No.

Slightly longer answer: The recent increases in housing costs are multifactorial, but none of those factors are the same as the 2008 dumpster fire. Also, all real estate is local, and the Fargo/Moorhead real estate market is stable.

The Full-Monty-Whole-Kitten-Kaboodle Answer:

The Fargo-Moorhead housing market in 2025 does not exhibit signs of an imminent bubble burst akin to the 2008 financial crisis. While affordability challenges persist, the market's fundamentals remain relatively stable. Let’s first take a look at what caused the 2008 crisis:

- Housing Bubble: Home prices rose rapidly in the early 2000s due to high demand.

- Easy Credit: Banks gave out home loans (mortgages) to people with poor credit (called subprime borrowers), often with low initial interest rates that later ballooned.

- Risky Investments: These risky mortgages were bundled into complex financial products (mortgage-backed securities and collateralized debt obligations) and sold to investors worldwide.

- Lack of Regulation: Financial institutions took on huge risk without enough oversight or understanding of how unstable these mortgage assets were.

The dumpster fire that ensued:

- Defaults Rose: Borrowers couldn’t afford rising payments, and many defaulted.

- Home Prices Crashed: The housing bubble burst, prices plummeted, and homeowners owed more than their homes were worth (underwater).

- Banks Collapsed: Big financial institutions like Lehman Brothers failed, triggering a global credit freeze. But also people who had jobs were restricted from refinancing.

- Recession Followed: The crisis led to a severe global recession, with millions losing homes, jobs, and savings.

While it is true that property prices and tax assessments have increased rapidly over the last five years, the majority of that falls to inflation and high demand. Because of regulatory action since 2008 we do not see the type of high-risk lending behavior that served as the springboard for that crisis.

Current F/M Market Overview:

- Home Price Trends: As of April 2025, Fargo's median home prices have shown moderate year-over-year increases: 1-bedroom homes rose by 17.8%, 2-bedroom by 6.5%, and 3-bedroom by 5.2%. But larger homes saw smaller gains or remained flat. This is because there is increased demand for median homes and starter homes due to both population increase overall but also a surge in the retirement-age population wanting to downsize.

- Inventory Levels: The number of homes for sale in Fargo increased by 21.5% from March to April 2025, indicating a gradual improvement in supply. However, the cost of building new with current product costs means the majority of those new build homes are larger and more expensive (though there are certainly exceptions, which we’d love to share about with you over coffee!).

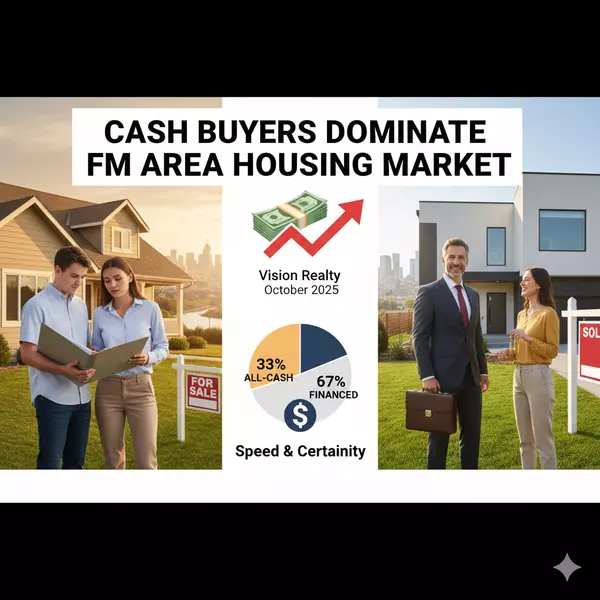

- Sales Activity: After a slowdown in 2023, the market is experiencing renewed activity in 2025, with more buyers and sellers re-entering the market as mortgage rates stabilize.

Affordability Concerns

Despite stable market conditions, affordability remains a concern. Experts have noted that the current market is among the least affordable in two decades, with median home prices around $420,000, while prospective buyers aim for homes priced near $259,000.

Risk Assessment

The Fargo-Moorhead area is not listed among the U.S. metro areas most at risk for home price declines in 2025 . Additionally, North Dakota's housing market is expected to experience moderate price increases, with no indications of a downturn.

Conclusion

At Vision Realty, we specialize in walking people through the home-buying and investment property purchasing experience. We have contacts in finance, accounting, retirement and construction who help our clients with even the most complex questions and circumstances! Whatever your property needs, ask us first!

Categories

Recent Posts

GET MORE INFORMATION